President Joe Biden has unveiled a policy designed to spur conversions of empty commercial buildings to residential use. The plan calls for public financing of office-to-residential projects, the sale of some federal properties, and targeted tax incentives.

“Office and commercial vacancies across the country are affecting urban downtowns and rural main streets,” the White House said in a statement announcing the initiative.

Interest in office-to-residential conversions has been growing, driven by two trends.

Since the pandemic, office vacancy rates have soared, creating a glut of office space. Workers simply aren’t coming downtown in the same numbers that they did before the pandemic.

At the same time, a housing shortage has squeezed renters and homebuyers. Home prices and rental prices have soared in recent years. Meanwhile, many Americans are interested in living downtown.

That creates clear demand for office-to-residential conversions.

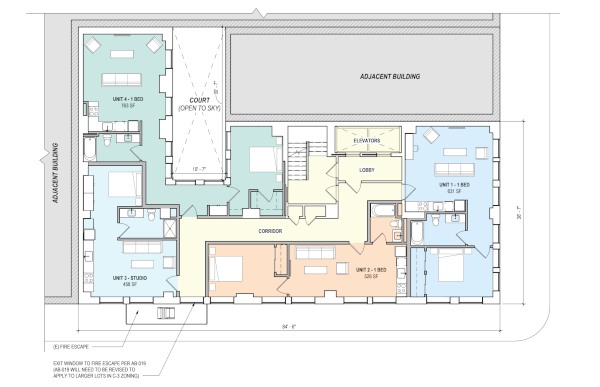

However, conversion projects have been hampered by a number of obstacles. A big challenge is that the layout of modern office buildings doesn’t lend itself to residential conversions. The typical office tower puts bathrooms near the elevators, a design feature that minimizes plumbing costs. But residential towers need bathrooms and kitchens in every unit, a reality that raises the cost of converting an office building to apartments or condos.

As a result, most office-to-residential conversions have focused on older buildings with smaller floor plates.

To help conversions make sense, the White House plan — Sparking Investment through New Federal Funding and Repurposing Property — calls for an alphabet soup of new proposals. See a summary here.

More on office-to-residential conversions appears in the December issue of Downtown Idea Exchange newsletter. Click to learn more about Downtown Idea Exchange and other resources for revitalizing downtowns and commercial corridors.